Your Spending Tells Your Story

What We Avoid Seeing in Our Spending

If you look closely, you’ll find that few people have a clear picture of where their money actually goes. Maybe it’s not ignorance, but avoidance. Looking at our spending forces us to confront the things we overspent on — and the purchases we could have lived without.

MoneyCircle

Spending Reflects What We Value

If you truly want to understand someone, looking at a month of their spending might be more revealing than having a long conversation.

Money is a limited and valuable resource for everyone, and the way it’s allocated clearly reflects a person’s priorities. Within spending records, you can see tastes, eating habits, and the everyday choices that quietly shape a life.

That’s why spending deserves to be kept close — and looked at often. Unlike a diary, spending records are far less emotional, and perhaps more honest.

They don’t show who we feel we are, but who we actually are, proven in numbers.

Why MoneyCircle Started

MoneyCircle started from this exact idea.

The goal was simple: to focus entirely on understanding one’s spending.

When the app first launched, it didn’t even include an income input feature. Rather than trying to do everything, we focused on making it easy to record where money was spent and how much — and to see it all at a glance. MoneyCircle values the power of simplicity above all else.

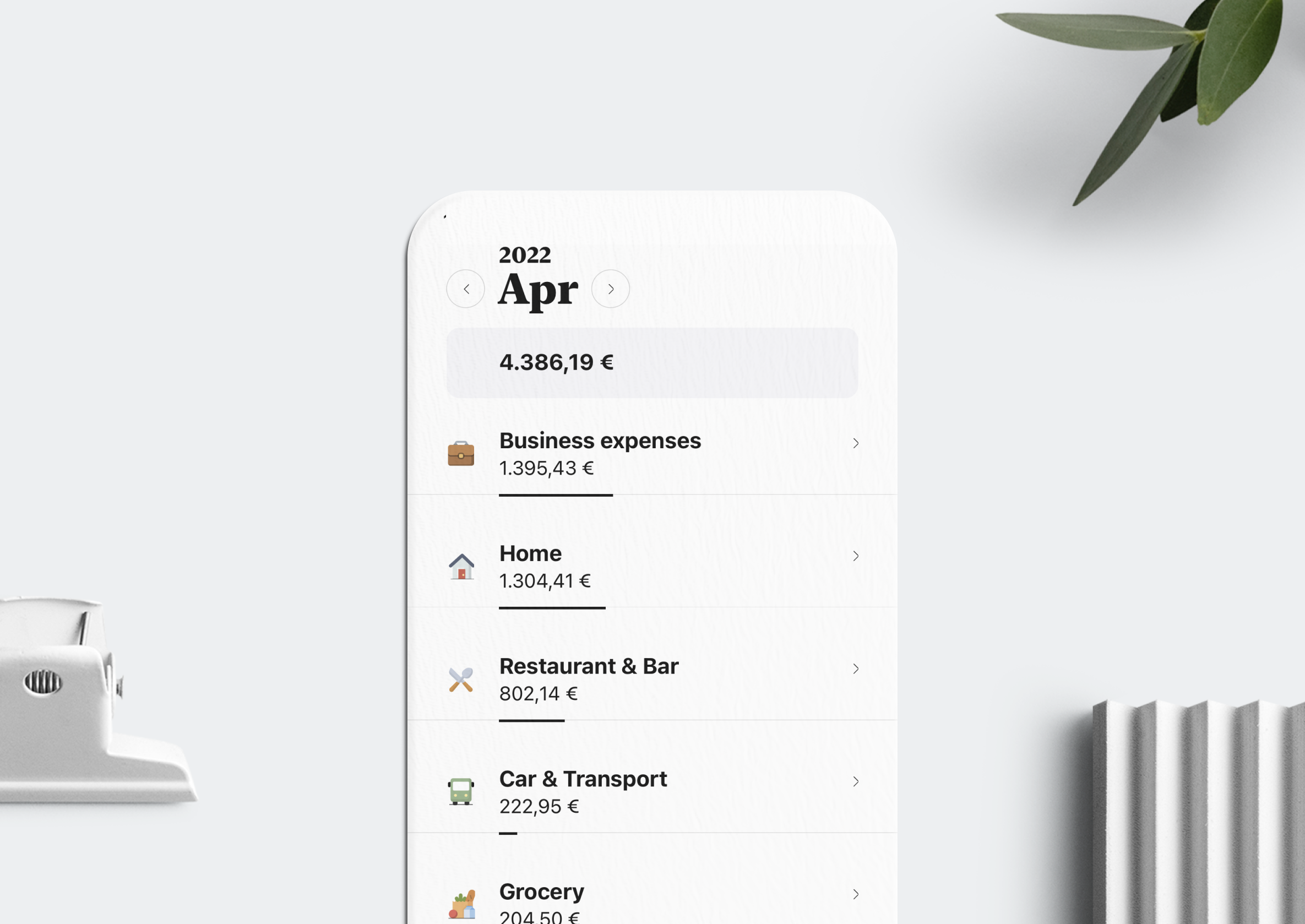

MoneyCircle - Home

What You See First Matters

The home screen is built around a simple list of categories. What’s interesting is that information most expense-tracking apps hide in a separate reports tab is placed front and center instead. Categories are automatically sorted by spending amount, so the moment you open the app, it’s immediately clear where most of your money is going. From the home screen, you can tap a category to view detailed entries, or add a new expense right away if needed.

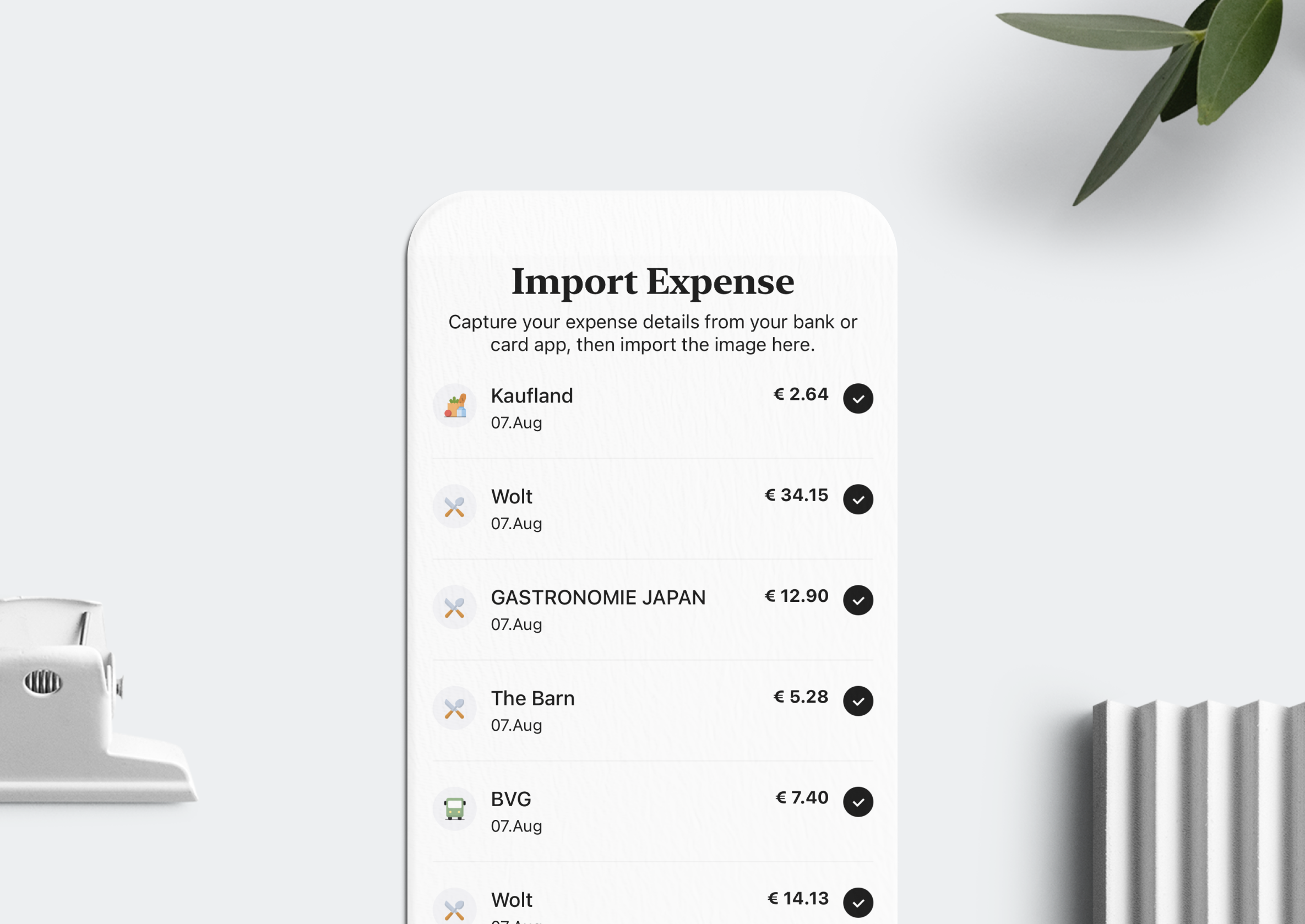

MoneyCircle - Import Expense

The Value of a Little Friction

Instead of relying on automatic bank integrations, MoneyCircle takes a different approach. By capturing a screenshot of your card or bank statement, the app automatically reads and records the relevant information. If most of your spending happens through card payments, adding expenses once a day by capturing your transaction history can be surprisingly convenient.

More importantly, this small moment of review — looking at each expense before it’s recorded — helps make spending more visible and more conscious. Rather than handing everything over to a mechanical sync, MoneyCircle encourages you to pause and reflect on how you spend.

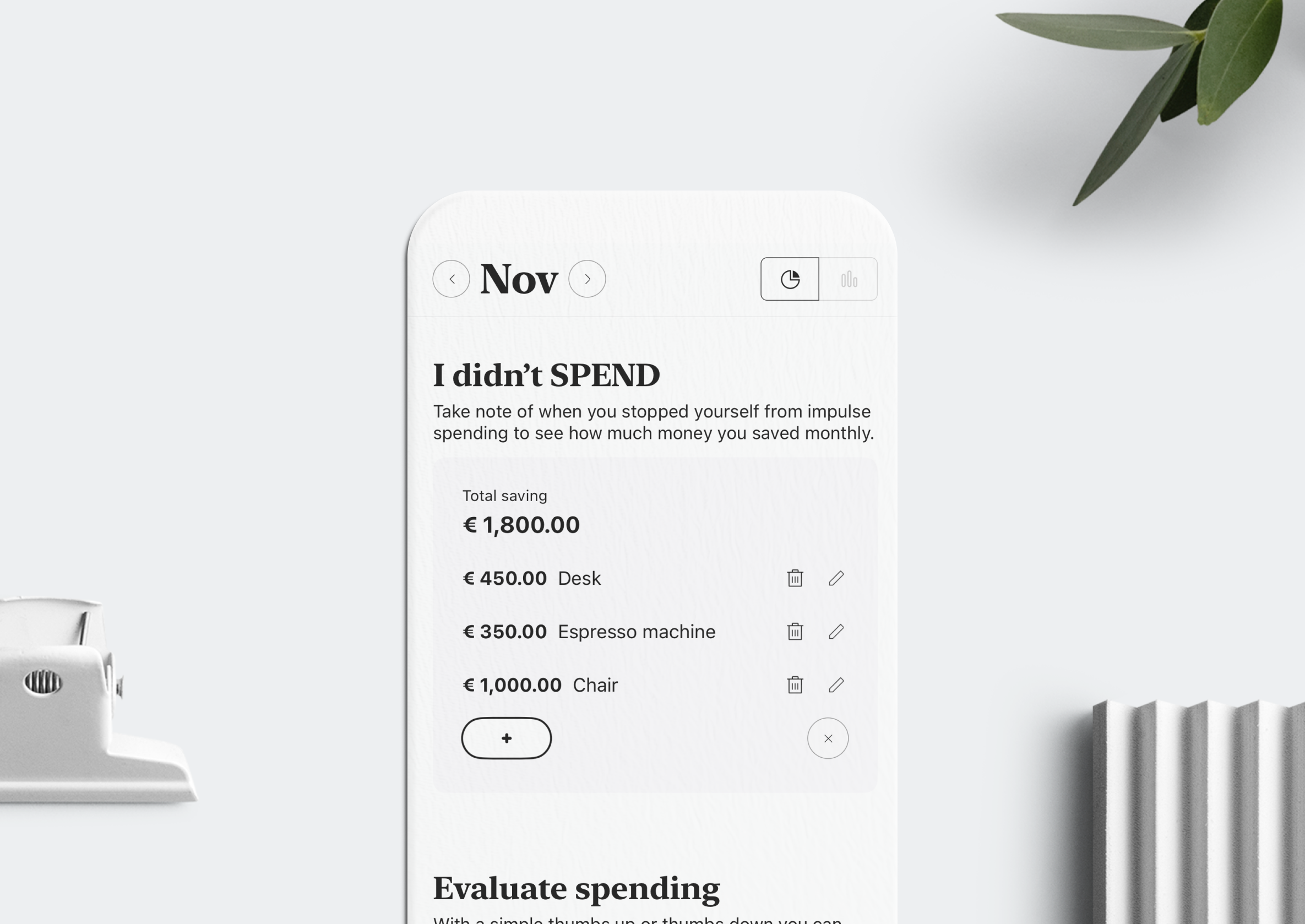

MoneyCircle - non-spending

Tracking Money You Didn’t Spend

MoneyCircle lets you record not only the moments when you spend, but also the choices you make not to. Tracking expenses can sometimes feel stressful, but recording a decision not to spend often feels like an achievement in itself.

If you resist the urge to make an impulse purchase, you can log it as a “non-spending” entry and see how much you’ve saved over the course of a month. And when you’re unsure about buying something, try adding it here instead of checking out right away. Giving yourself a few days to reflect on whether it’s truly necessary can become another meaningful way to use the app.

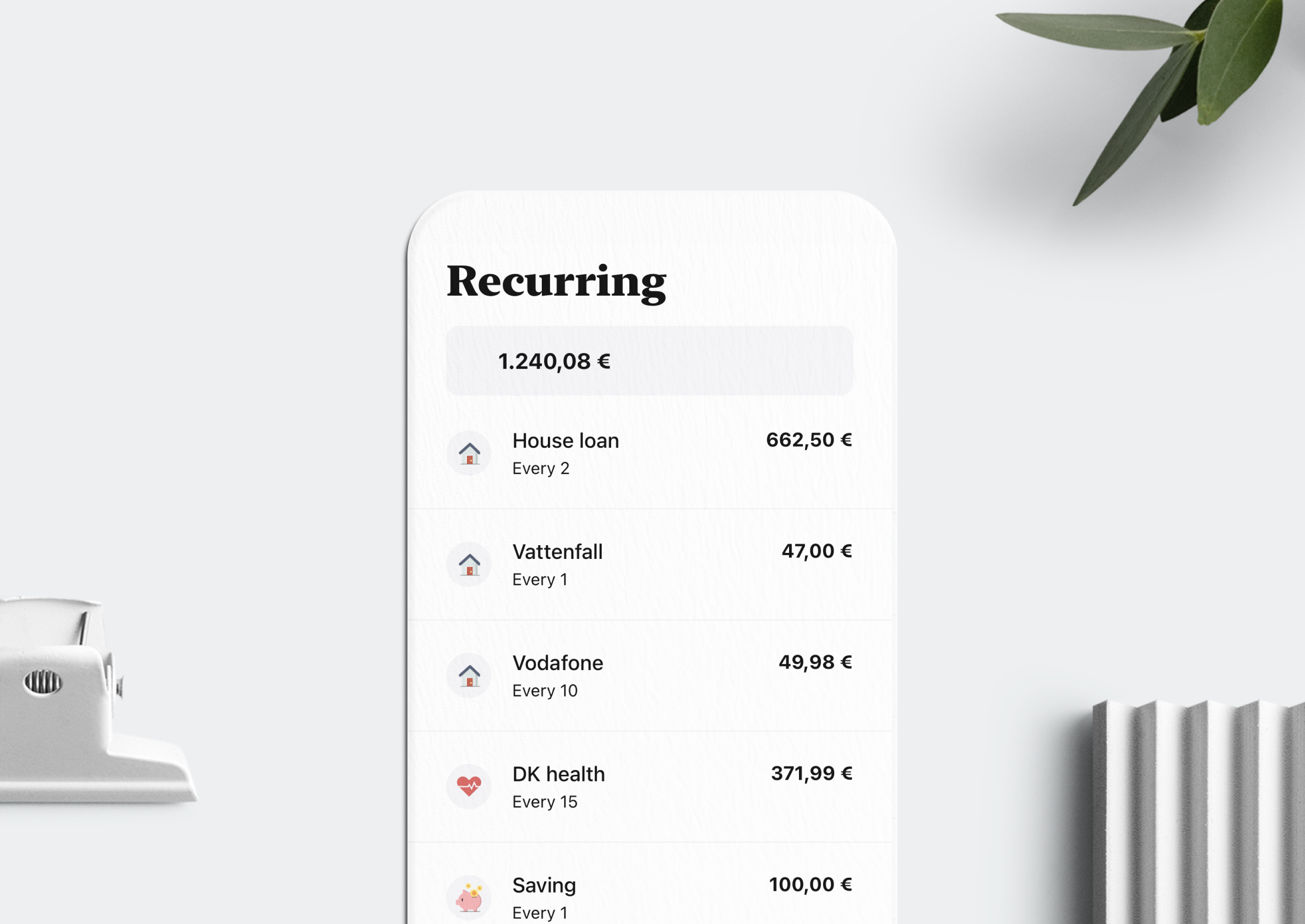

MoneyCircle - Recurring expenses

Understanding Recurring Expenses

Truly understanding your recurring expenses may be the most realistic way to begin saving. In MoneyCircle, once you register a recurring expense, it’s recorded automatically each month.

But the heart of this feature isn’t convenience — it’s awareness. The moment you clearly see how much money quietly leaves your account every month, real expense management finally begins.

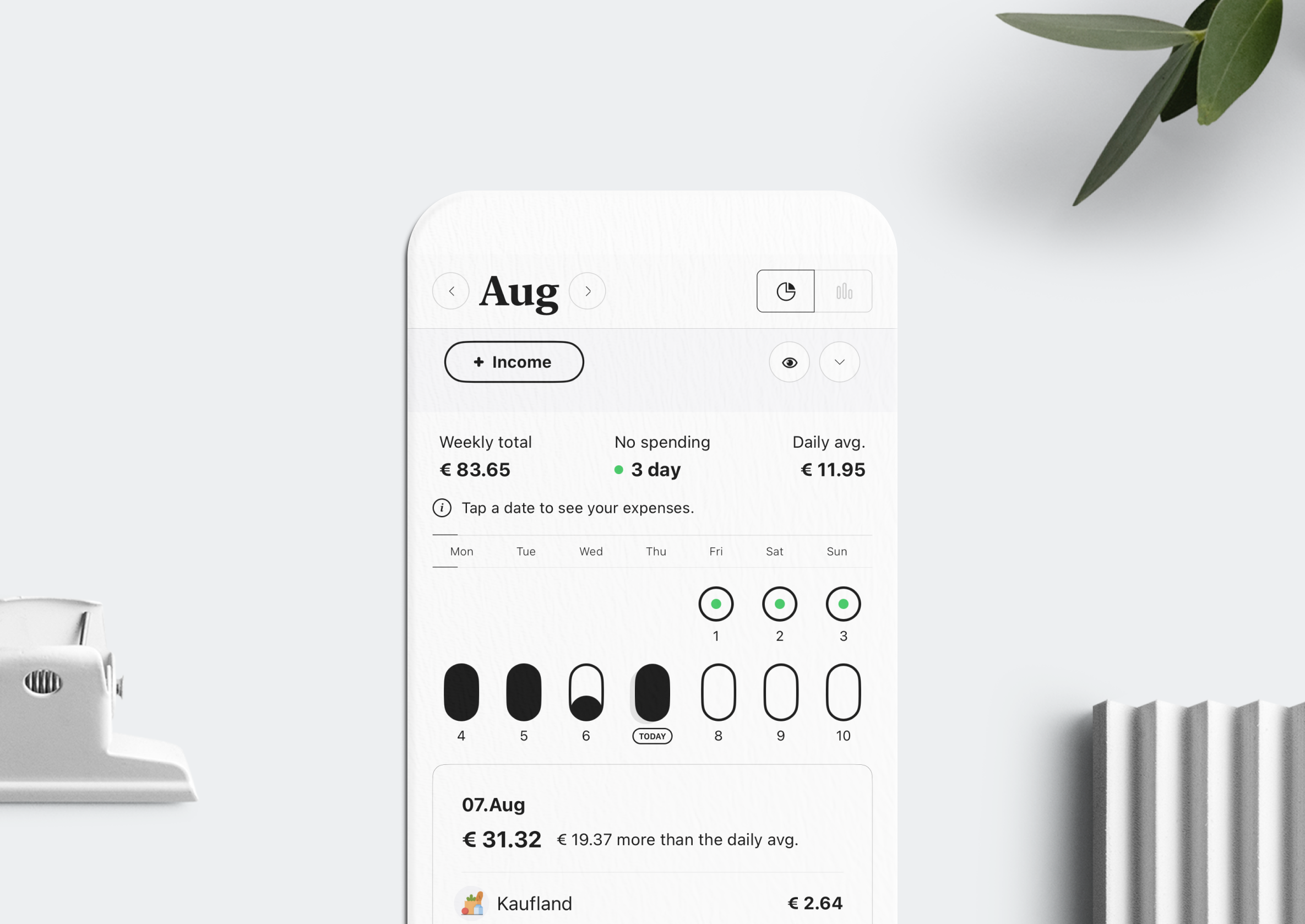

MoneyCircle - Monthly Report

Seeing Patterns at a Glance

In the Reports tab, you can explore your spending patterns through a range of indicators. It also shows the number of days with no spending at all, which makes it easy to set small, realistic goals — like aiming for at least three no-spend days in a month. The calendar view lets you review expenses by date, while category trends reveal at a glance where you may be exceeding your budget.

No matter the method, recording and reviewing spending still comes with a certain level of discomfort. Money often feels scarce, and expenses tend to look heavier than income. Even so, understanding how we spend is essential. It helps ensure that the money we work hard to earn is ultimately used more wisely — for ourselves.

MoneyCircle - iPad Version

Lastly,

We hope MoneyCircle can make the act of looking at your spending feel just a little less stressful. If it helps you understand your spending patterns — and save more as a result — that would be more than enough.

It’s not a finished product yet, but I hope MoneyCircle can remain a tool that accompanies you through that process.

MoneyCircle App Store: https://apps.apple.com/app/id1618265694